|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Mozambique/Global: Who Pays for Transnational Corruption?

AfricaFocus Bulletin

January 8, 2019 (190108)

(Reposted from sources cited below)

Editor's Note

The line-up of those involved in this $2.2 billion fraudulent loan deal, now

implicated in a case in the U.S. District Court of the Eastern District of New York,

is multinational. The five named individuals indicted include the former Minister of

Finance of Mozambique, a Lebanese businessman representing Privinvest (an

international shipping conglomerate in Abu Dhabi), and three London-based bankers,

citizens of New Zealand, Great Britain, and Bulgaria, employed at the time of the

loans by the giant Swiss bank Credit Suisse. Three more names are redacted in the

indictment and 5 others, three Mozambicans and two additional employees of

Privinvest, are cited but not named in the text of the indictment.

This indictment may result in convictions and/or financial forfeitures for some

individuals, and will almost certainly result in more revelations and political

fallout in Mozambique. But it is notable that neither Credit Suisse nor VTB, a

Russian bank which bought into further marketing of these loans, are identified by

name. Credit Suisse is one of the largest global banks. But while similar cases have

sometimes resulted in penalties for the banks involved, critics note that similar

strategies are not yet being contemplated for Credit Suisse, VTB, or Privinvest, by

the U.S. Department of Justice or other relevant governments, and that the Mozambican

people are still being held liable for these illegal debts.

This case is of interest not only for Mozambique, but as a case study of a pattern

which is probably more a rule than an exception in today´s global economy. Whatever

the results, the clear lesson is that only transnational cooperation can track down

(and hopefully also penalize) transnational corruption.

This AfricaFocus Bulletin contains recent reports from two of the most regular and

reliable sources of news and analysis on Mozambique: Joseph Hanlon´s News Reports and

Clippings, and the English-language version of the Mozambican News Service, edited by

Paul Fauvet. While the latest versions are often available first by email or through

Facebook, they are also archived on the web and can be found with Google searches.

Since court hearings are upcoming in Johannesburg and later in the month in New

York, additional news may also be appearing in the financial press.

For previous AfricaFocus Bulletins on Mozambique,visit

http://www.africafocus.org/country/mozambique.php For previous AfricaFocus Bulletins

on debt and illicit financial flows, visit http://www.africafocus.org/intro-iff.php

Among other recent sources with relevant background and analysis:

(1) The Center for Public Integrity in Mozambique, in a press release on January 6,

demanded that ¨the Government of Mozambique should immediately suspend the

restructuring of [this debt,] which implies suspension of all agreements reached with

the international creditors now holding title to these secret debts.¨

http://tinyurl.com/y9jqv4dr

(2) Jubilee Debt Campaign, UK, ¨What we have learned from the US indictment on odious

loans to Mozambique,¨ Jan. 4, 2018

https://jubileedebt.org.uk � Direct URL: http://tinyurl.com/ychc8jl8

(3) ¨Following the donor-designed path to Mozambique's $2.2 billion secret debt

deal,¨ by Joseph Hanlon, Third World Quarterly, October 2016

http://tinyurl.com/y72kgegm

Puts the debts in the context of previous policy pressures on Mozambique by donors

and creditors

++++++++++++++++++++++end editor's note+++++++++++++++++

|

Mozambique 429 - US says Chang received $12 mn; full indictment report - News reports

& clippings

5 January 2019

Editor: Joseph Hanlon ([email protected])

To subscribe: http://tinyurl.com/sub-moz

Previous newsletters and other Mozambique material are posted on http://bit.ly/mozamb

The full indictment is posted on http://bit.ly/ChangIndict

Chang received $12 mn says US indictment; 2 others on list not arrested yet

The indictment against Manuel Chang and others was published on 3 January. Two other

senior Mozambicans have also been charged but their names are blacked out, as they

have not yet been arrested. These two are alleged to have received $36.5 mn in

"bribes and kickbacks". Chang is said to have personally received $12 mn. Three

"Mozambican co-conspirators" who are not charged, presumably because they cooperated

with the US Department of Justice, received $23 mn in bribes. But the largest

payment, $45 mn, went to Andrew Pearse, the then Credit Suisse (CS) managing director

who orchestrated the secret loan deal.

The indictment, issued by a Grand Jury at a US district court in New York on 19

December, shows the large amount of information already provided to the US department

of Justice, including emails and other documents. These make clear the secret loans

were corrupt for the start, going to the top.

Eight people are charged, the three Mozambicans, two senior people from the Abu Dhabi

company Privinvest which received the money and was to supply ships and coastal

protection equipment, and three senior people then at Credit Suisse.

Thus the indictment is not just against the Mozambicans who took the loans and

received bribes, but also against CS senior officials for organising fraudulent loans

and Privinvest for charging "inflated prices" which it then used "to pay bribes and

kickbacks". The full indictment is posted on

http://bit.ly/ChangIndict

Excerpt from the indictment

A. Overview

24. Through a Series of financial transactions between approximately 2013 and 2016,

Proindicus, EMATUM and MAM borrowed in excess of $2 billion through loans guaranteed

by the Mozambican government. The loans were arranged by Investment Bank 1 and

Investment Bank 2 and sold to investors worldwide, including in the United States.

Over the course of the transactions, the co?conspirators, among other things,

conspired to defraud investors and potential investors in the Proindicus, EMATUM and

MAM financings through numerous material misrepresentations and omissions relating

to, among other things: (i) the use of loan proceeds, (ii) bribe and kickback

payments to Mozambican government officials and bankers, (iii) the amount and

maturity dates of debt owed by Mozambique, and (iv) Mozambique´s ability and

intention to pay back the investors.

25. Each of the companies entered into contracts with Privinvest to provide equipment

and services to complete the maritime projects. The loan proceeds were supposed to be

used exclusively for the maritime projects, and nearly all of the borrowed money was

paid directly to Privinvest, the sole contractor for the projects, to benefit

Mozambique and its people. In reality, the defendants JEAN BOUSTANI, ANDREW PEARSE,

SURJAN SINGH and DETELINA SUBEVA, together with others, created the maritime projects

as fronts to raise money to enrich themselves and intentionally diverted portions of

the loan proceeds to pay at least $200 million in bribes and kickbacks to themselves,

Mozambican government officials and others.

|

London Offices of Credit Suisse

Bribe planning came first

The indictment makes clear that the whole idea came from CS and Privinvest and that

Privinvest had to "persuade Mozambican government officials" to accept the deal. The

indictment says that "almost immediately [Jean] Boustani and [the redacted

Mozambican] negotiated the first round of bribe and kickback payments that Privinvest

would have to make for the benefit of Mozambican government officials for the project

to be approved."

On 11 November 2011 the redacted Mozambican wrote an email to Jean Boustani, a senior

executive at Privinvest: "To secure the project is granted the go-head by the HoS

[Head of State, Armando Guebuza], a payment has to be agreed before we get there, so

that we know and agree, well in advance, what ought to be paid and when." Boustani

replied the same day that because of "negative experiences in Africa" Privinvest now

had a policy that no money could be paid before a contract was signed. On 14 November

2011 the redacted Mozambican agreed that part of the bribes would be paid on signing

and part when the project started.

But the Mozambican warned in the e-mail that by the time of project implementation

"there will be other players whose interest will have to looked after, e.g. ministry

of defense, ministry of interior, air force, etc". Money must be paid early because

"in a democratic government like ours people come and go, and everyone involved will

want to have his/her share of the deal while in office, becomes once out of the

office, it will be difficult. So it is important that the contract signing success

fee be agreed and paid in once-off, upon the signing of the contract."

In another e-mail exchange on 28 December 2011, it was agreed that $50 mn in bribes

would go to Mozambican government officials and $12 mn in kickbacks for Privinvest

co-conspirators. It took a further year of negotiation. The ProIndicus contract with

Privinvest was signed on 18 January 2013, and the first bribes were paid five days

later.

Will Credit Suisse wiggle out?

�The indictment alleges that the former employees worked to defeat the bank�s

internal controls, acted out of a motive of personal profit, and sought to hide these

activities from the bank,� Credit Suisse said in a statement, adding that the bank

would continue to cooperate with authorities. But the indictment also makes clear how

easy it was for Andrew Pearse, head of CS's Global Financing Group, and the others to

bypass the bank's internal controls, and how little check there was on their

activity.

CS is not charged in this indictment, but it will still be argued that the

combination of pressure to lend and very light controls encouraged misconduct. The

indictment also makes clear that CS and Privinvest pushed the loan and had to offer

significant bribes before the Mozambicans would accept. So pressure will remain on CS

to accept some liability for the $2 bn secret debt.

Britain declines to prosecute $ laundering & leaves it to the US

Many of the actions being prosecuted in the US case took place in London at the

Credit Suisse (CS) branch there, and the three ex CS employees were arrested in

London on 3 January. The Financial Times (FT, 11 Nov 2018) reported that the British

Financial Conduct Authority (FCA) told CS in August 2018 that it had dropped its

criminal probe into the secret loans. The FT commented that "the U-turn is a boon to

the bank as the FCA was previously looking to use its criminal money-laundering

powers in what would have been one of the first cases of its kind."

The FT notes that the FCA has yet to file charges in any criminal money laundering

case.

Comment: The UK has taken harsh action against Mozambique because of the $2 bn secret

debt, cutting off all aid directly given to government. By dropping the case against

CS, it makes clear it will punish poor countries taking bribes, but not London banks

giving bribes.

The people of Mozambique suffer twice - first from a corrupt government, and then by

the UK cutting off aid to health and education. But in London, the corruptors go free

- until the United States demands the arrests of the bribe givers.

It leaves the UK looking just like Mozambique, refusing to prosecute the guilty, and

punishing the poor but not the rich.

But in Britain's case, the reluctance to prosecute CS and money laundering may be

understandable. If the UK leaves the European Union, it will increasingly be

dependent on illegal money to keep the economy afloat. And it will need the support

of the big global banks. jh

Civil society says arrests "should embarrass" UK

"The arrest of three Credit Suisse bankers should embarrass the FCA, as it shows that

the FCA decision failed to fulfil the organization�s basic statutory standards, and

suggests that UK regulators did not apply the necessary due care in handling the

Mozambican debt case," said the Budget Monitoring Forum (FMO, Forum de Monitoria do

Orçamento), a Mozambican civil society coalition. FMO adds that if FCA "internal

constraints � affect their ability to take appropriate action against Credit Suisse,"

FMO is willing to assist.

"The nature of charges also reinforces our view that the Mozambican illegal debt

crisis is a consequence of criminal activity spanning various jurisdictions including

the UK, Norway, Netherlands, Switzerland and the UAE."

"FMO rejects Credit Suisse�s attempts to distance itself from its former employees.

As we have previously stated ,the failure of Credit Suisse to lay criminal charges

against its former banker Andrew Pearse, responsible for the sovereign debt deals who

joined the contractors benefitting from the illegal Ematum loans, suggests that

illegal, immoral and negligent conduct was not by a rogue banker, but rather part of

systemic Credit Suisse culture. "

The full FMO statement is below and at bit.ly/FMO-Moz-CS

Hidden Debts: Ematum � A Fraud from the Start

https://allafrica.com/stories/201901070064.html

Maputo, 6 Jan (AIM) � The scandal-ridden Mozambique Tuna Company (Ematum) was set up,

not to catch tuna, but to divert funds into private pockets, according to the

indictment drawn up by US prosecutors, investigating Mozambique�s �hidden debts�.

Tuna fishing boats sit in Maputo. Purchased from Privinvest, they have never been

used for fishing.

Five people have so far been arrested on international warrants issued by the United

States. They are: former Mozambican Finance Minister, Manuel Chang; three former

executives of the bank Credit Suisse, Andrew Pearse, Surjan Singh and Detelina

Subeva; and Jean Boustani, the lead salesman and negotiator for Privinvest, the Abu

Dhabi based concern that was the sole contractor for Ematum and for two other

fraudulent companies, Proindicus and MAM (Mozambique Asset Management).

The indictment makes it clear that Ematum was not a genuine fishing venture gone

wrong, but a scam from beginning to end.

The fraudsters, having easily evaded the internal controls of Credit Suisse when

negotiating the first illicit loan (to Proindicus), embarked on an even bigger

swindle, seeking 850 million dollars for Ematum. In August 2013, Credit Suisse agreed

to make up to 850 million dollars available for Ematum.

As Finance Minister, Chang signed the loan guarantee � Credit Suisse could lend the

money, comfortable in the knowledge that if Ematum failed to repay, the government

(i.e. the Mozambican taxpayer) would be liable for the whole amount.

The guarantee was entirely illegal � it violated the ceiling on loan guarantees in

the budget law, and a clause in the Mozambican constitution which states that only

the country�s parliament, the Assembly of the Republic, could authorise such debt.

But in the event Credit Suisse seems to have had second thoughts � in September 2013,

it only lent Ematum 500 million dollars. Ematum sought the rest of the money from a

second bank, VTB of Russia.

The Ematum scheme, the indictment argues, was cooked up in May 2013 by Boustani,

Pearse and Subeva. The fraudsters devised a project that had nothing to do with

Mozambique�s legitimate fishing needs: instead, the project was �a pretext to justify

the maximum possible loan amount�.

Part of the money was not for Ematum at all, but was intended to carry on paying for

the earlier fraudulent scheme, Proindicus. Boustani sent an e-mail on 21 July 2013,

saying �we will go for 800 million dollars so we keep a cushion for Proindicus

interest payment next year�.

On the same day, Subeva e-mailed �We should also keep a cushion for Proindicus of 17

million dollars so that we don�t need to go back to MoF (Ministry of Finance) and

they are on our side�.

Pearse and Subeva were still employed by Credit Suisse, but they �sought to conceal

their involvement in setting up the Ematum project by using personal e-mail accounts

and removing all reference to themselves in the documents they prepared�.

In an e-mail to Boustani in late July 2013, Pearse said �Pls bro don�t just forward,

but create new e-mail and attach the docs�. Credit Suisse, he added, �is very

sensitive to seeing our names involved�.

Since Credit Suisse might wonder why the Ematum contract was going to Privinvest, the

fraudsters, the indictment says, �created fake competing bids for contracts�. Fully

aware that there was no proper tender, Boustani e-mailed Pearse at the end of July,

suggesting �Let�s say they contacted South African shipyards and Spanish and

Portuguese. Without naming them�.

Surjan Singh then �included fake bid information� in a memorandum sent to Credit

Suisse, �falsely asserting that the Privinvest proposal was deemed the most

competitive one in comparison to bids from three other international companies�.

Credit Suisse�s internal procedures were so shoddy that it put Singh in charge of the

due diligence for the Ematum loan. Singh, Pearse and Subeva, adds the indictment,

�provided talking points and suggested answers to Mozambican government officials for

due diligence meetings�.

Surjan was richly rewarded, Between October 2013 and February 2014, Privinvest wired

six payments, totalling 4.49 million dollars to Singh�s account in the United Arab

Emirates. These payments went via corresponding banks in New York � one of the many

reasons for US prosecutors to take a direct interest in the scandal.

By 8 April 2014, Boustani had also paid seven million dollars to Chang, and bribed as

yet unnamed Mozambican government officials to the tune of 36 million dollars.

The Ematum fishing boats, built in a Privinvest-owned shipyard in Normandy, did all

arrive � but did virtually no fishing. The projections of vast revenues from the

export of tuna proved no more than a fantasy. In 2018, it was reported that the boats

did not even have fishing licences. From the new suspension bridge over the Bay of

Maputo, there is an excellent view of the Maputo fishing port, and any passer-by can

see all 24 Ematum boats lying idly at anchor.

In 2016, the original Ematum bonds (or �loan participation notes�) were swapped for

eurobonds directly issued by the Mozambican government. At the time it appeared as if

this was a Mozambican idea � extending the maturity of the bonds, but increasing the

interest on them.

But, according to the indictment, the idea came from the conspirators, including

Boustani, Pearse and Subeva and was intended �to hide from the public and the IMF the

near bankruptcy of the project companies, resulting from loan proceeds being diverted

as part of the fraudulent scheme�.

Although here was a new government in Maputo, and Chang was no longer finance

minister, Mozambican officials did not smell a rat. They hired Credit Suisse and VTB

to conduct the bond exchange. The adviser for the exchange was Palomar, a Privinvest

subsidiary � and by now Pearse and Subeva had moved seamlessly from Credit Suisse to

Palomar.

On 6 April 2016, the Ematum bondholders consented to exchange their bonds for

Mozambican government Eurobonds. But the documents on which they based this consent

did not mention the Proindicus and MAM loans, thus giving a completely misleading

picture of Mozambique�s foreign debt situation.

A couple of weeks later, thanks to an article in the �Wall Street Journal�, the

existence of Proindicus and MAM was suddenly revealed, and the Ematum/Eurobond

investors realised they had been deceived.

The IMF too was angered to find that the government had concealed the scale of the

country�s debts, and suspended its programme with Mozambique. These events

precipitated the financial crisis which came close to crippling Mozambique in

2016/2017. (AIM)

Budget Monitoring Forum (FMO), Maputo

Media Statement On The Recent Arrests Of The Former Minister Of Finance Of

Mozambique, Mr Manuel Chang In Johannesburg And Three Former Credit Suisse Bankers In

London In Connection With The $2.3 Billion Illegal Mozambican Debt

5 January 2019

http://bit.ly/FMO-Moz-CS

The Budget Monitoring Forum (FMO) - a coalition of Mozambican civil society

organisations working on public finance transparency and accountability � has noted

reports of arrest, at the request of US authorities, of former Minister Manuel Chang

in Johannesburg on 29 December 2018. We further have recorded the arrests of three

former Credit Suisse bankers in London on the 3 January 2018.

FMO believes that the US initiated process is an opportunity for Mozambicans to get

full disclosure on the illegal debts and recover all costs incurred by the Mozambican

fiscus as a result of illegal and immoral conduct by international bankers,

contractors, public officials, their relatives and collaborators in Mozambique. FMO

also expects that this is a beginning of a global process, which will culminate in

holding - all responsible parties accountable for their respective roles in this

crisis. We fully endorse the proposed criminal sanctions, as they will serve as a

deterrent for corrupt activities in Mozambique and beyond.

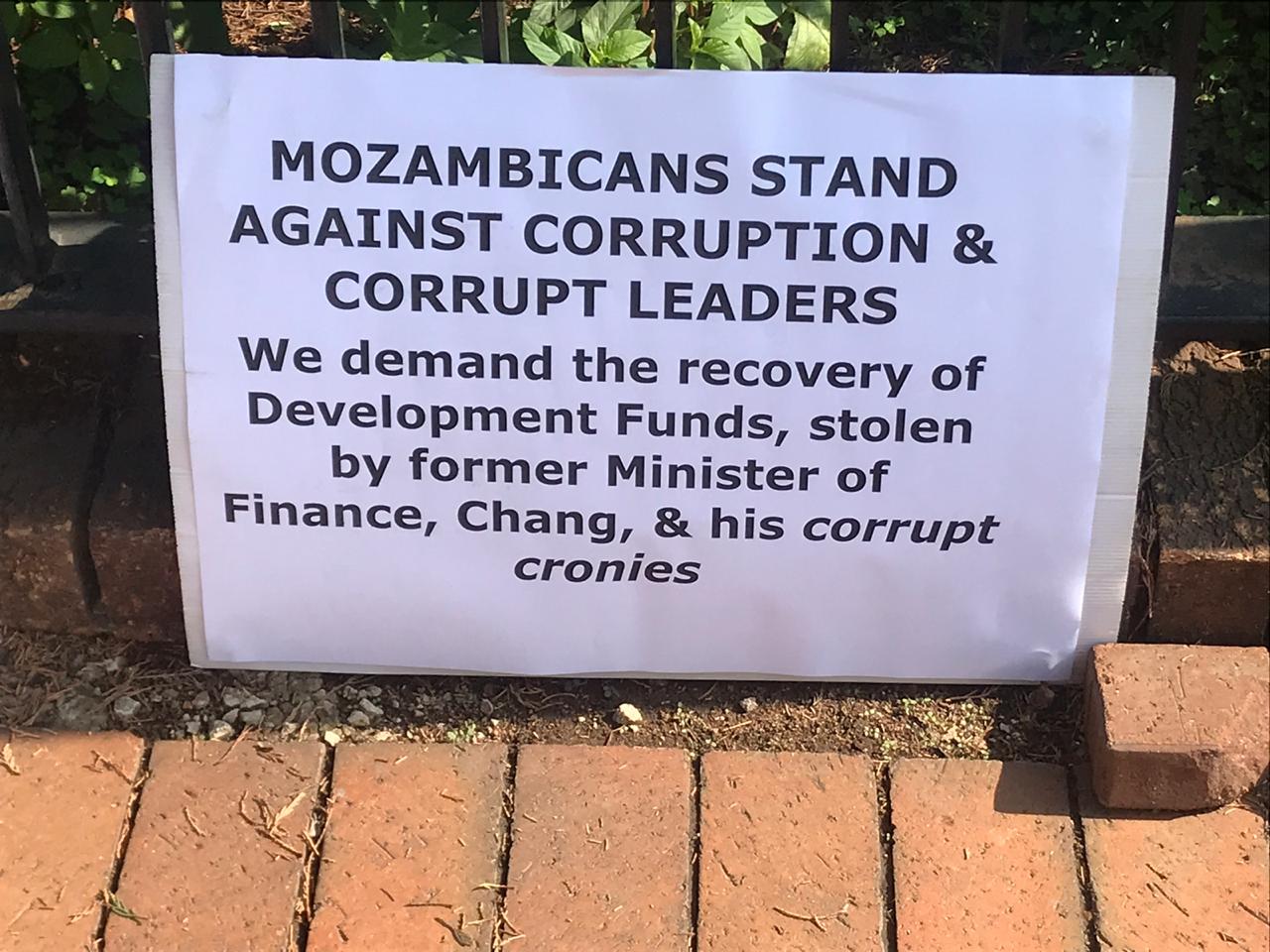

Mozambicans demonstrate in South Africa outside extradiction hearing

for former Finance Minister Manuel Chang.

Credit: https://www.facebook.com/CIP.Mozambique/

Recent developments confirm our long standing position that the $2.3 Billion debt was

illegal as it did violated the Mozambican legislation. We have further argued that

the entire process around the illegal debt - including the relationships between

international bankers, various contractors and beneficiaries was intended to conceal

criminal activity including money laundering.

FMO has long concluded that the criminal sovereign debt project, masterminded in

concert with international banks, deliberately sought to divert much needed resources

from the Mozambican people. As such we will continue to campaign against any debt

restructuring proposals that do not consider the criminal nature of these

transactions. Mozambican people should not bear the burden for collusive and illegal

behaviour between the Government of Mozambique, and the international bankers.

Mozambicans have been paying a heavy price as resources are diverted for illicit

purposes depriving our nation of crucial resources needed for sustainable economic

growth and development. The beneficiaries of proceeds from illegal debt (politicians,

contractors, international banks) should adsorb all costs associated with the

Mozambican debt crisis - in addition to facing criminal sanctions being pursued by

the US authorities.

The nature of charges also reinforces our view that the Mozambican illegal debt

crisis is a consequence of criminal activity spanning various jurisdictions including

the UK, Norway, Netherlands, Switzerland and the UAE.

Recent arrests validate our position as outlined in the statement (18 November 2018)

that the UK�s Financial Conduct Authority (FCA) should pursue criminal sanctions

against Credit Suisse for the role played by the UK regulated Bank in Mozambique�s

illegal debt crisis. We remain dismayed by the approach adopted by the UK authorities

and lawmakers in holding Credit Suisse accountable for its actions.

The arrest of three Credit Suisse bankers should embarrass the FCA, as it shows that

the FCA decision failed to fulfill the organization�s basic statutory standards, and

suggests that UK regulators did not apply the necessary due care in handling the

Mozambican debt case. We expect the FCA to reconsidertheir decision and continue to

pursue action against UK regulated entities implicated in this scandal. FMO

representatives are willing to make themselves available to assist FCA to augment

internal constraints which might affect their ability to take appropriate action

against Credit Suisse, and other implicated parties in the illegal debt project.

FMO rejects Credit Suisse�s attempts to distance itself from its former employees. As

we have previously stated the failure of Credit Suisse to lay criminal charges

against its former banker � Andrew Pearse, responsible for the sovereign debt deals

who joined the contractors benefitting from the illegal Ematum loans�suggests that

illegal, immoral and negligent conduct was not by a rogue banker, but rather part of

systemic Credit Suisse culture. FMO is relieved that our views around Mr Pearse and

others have found expression in the legal action led by US authorities.

While FMO is encouraged by recent action to hold various parties accountable for

illegal debt, we will continue with our global campaign, as announced in November to

encourage other regulators and governments to take appropriate corrective action

against implicated parties. We call on other jurisdictions and implicated countries

to follow the US lead and pursue charges against institutions and individuals who

were party to the grand corruption project, the illegal debt project. FMO demands

that:

- Mozambican people should not be expected to repay illegal debts, especially as

there is concrete evidence of criminality.

- Any claims arising out of illegal debts must be brought against the International

Banks, contractors, and any other beneficiary of proceeds from the illegal debt

For media enquiries, please contact: Denise Namburete, FMO, [email protected],

00 258 82 30 28 001 Jorge Matine, FMO, [email protected]; 00 258 84 67 17 432

AfricaFocus Bulletin is an independent electronic publication providing reposted

commentary and analysis on African issues, with a particular focus on U.S. and

international policies. AfricaFocus Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at [email protected]. Please write to this

address to suggest material for inclusion. For more information about reposted

material, please contact directly the original source mentioned. For a full archive

and other resources, see http://www.africafocus.org

|