|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: Fossil Fuel Viability to Decline Sharply

AfricaFocus Bulletin

June 22, 2020 (2020-06-22)

(Reposted from sources cited below)

Editor's Note

�Falling demand and rising investment risk is likely to slash the

value of oil, gas and coal reserves by nearly two thirds, sending

shock waves through the global economy by hitting companies,

financial markets and countries reliant on exports, finds a new

report from Carbon Tracker. It warns that the fossil fuel industry

is approaching terminal decline because of competition from clean

technologies and tougher government policies to achieve climate

targets and increase energy security. The COVID-19 crisis is now

accelerating this: demand for oil could fall by 9% in 2020

according to the International Energy Agency.�

This AfricaFocus Bulletin contains the press release and executive

summary from this new Carbon Tracker report, as well as excerpts

from a report on South African civil society demands that Standard

Bank remove board directors linked to the fossil fuel industry for

conflict of interest.

Notably, other reports and news stories reinforce a dual message:

first, that continued investment in fossil fuels is increasingly

risky, and, second, that nevertheless movement away from fossil

fuels will still be bitterly resisted by vested interests and

require increased government action and civil society pressure to

move more rapidly.

There is already a strong market for business solutions providing integrated strategies for transition to 100% renewable energy, illustrated by those offered by the Finnish company W�rtsil�. In a recent op-ed W�rtsil� manager Risto Paldanius argues that energy storage technology already has enormous potential. His claim that this could soon make blackouts in Africa ancient history is likely over-optimistic, but the company is a global leader in integrated power solutions.

It has modeled 145 countries and regions to find the optimal way to produce electricity from 100% renewable energy sources. The model explores how the power system of each of these regions would look like if they were to be optimally built from scratch, not considering the burden of existing power plants. Each region has unique solar and wind conditions which makes the optimal energy mix for each region unique, as it explains in a short video, as well as a 19-page white paper, both available at this link: https://www.wartsila.com/energy?wvideo=65829ph0kx

In addition, the following links are a sampling of recent updates:

[Note: In some cases date and title are clear from the link, and are not written separately to save space.]

Global and USA developments

BBC, June 9, �Could the coronavirus crisis finally finish off coal?�

https://www.bbc.com/news/science-environment-52968716

Financial Times, May 28, �Clean power stocks outperform fossil fuel peers during pandemic�

https://www.ft.com/content/08675019-1386-49ac-a718-031d6ab85051

�Clean power stocks have weathered the coronavirus crisis better than their peers in oil and gas, new research has shown, as the oil price shock and pandemic shift the landscape for energy investing. US clean power stocks rose 2.2 per cent in the first four months of the year, while their fossil fuel peers fell 40.5 per cent, according to a study by Imperial College London and the International Energy Agency. The S&P 500 fell 9.4 per cent during the same period.�

New York Times, June 15, �Clean power stocks outperform fossil fuel peers during pandemic�

https://www.nytimes.com/2020/06/15/business/energy-environment/bp-oil-gas-write-down.html

GreenTechMedia, June 16, �BP Adopts $100 Carbon Price Assumption for 2030, With Big Implications for Clean Energy�

https://www.greentechmedia.com/articles/read/european-oil-majors-ready-to-scale-up-energy-transition-investment

�For BP, some drilling projects just don't make sense anymore. The European oil major said this week that it will write down as much as $17.5 billion from its oil and gas portfolio while baking in a new carbon price forecast of $100 per ton by 2030 � up from the $40 figure it factors in now.�

Common Dreama, �Research Shows 'Linking Climate Policy to Social and Economic Justice Makes It More Popular'�

https://www.commondreams.org/news/2020/06/12/research-shows-linking-climate-policy-social-and-economic-justice-makes-it-more

https://www.theguardian.com/environment/2020/jun/18/world-has-six-months-to-avert-climate-crisis-says-energy-expert

https://www.commondreams.org/news/2020/06/18/new-vatican-document-urges-fossil-fuel-divestment-serve-planet-and-common-good

https://www.bloomberg.com/news/articles/2020-06-18/3-years-and-3-trillion-could-shift-the-climate-change-narrative

Africa-specific links

https://www.dailymaverick.co.za/article/2020-04-24-to-recover-from-covid-19-sa-needs-green-new-deal/

African Energy Chamber, June 15, �Angola expects to implement a USD 400 million two-phase project in the clean energy segment�

https://www.africa-newsroom.com/press/governments-commitment-to-diversify-angolas-economy-continues-to-offer-opportunities-for-investors-in-the-power-sector

Friends of the Earth, June 15, �Gas in Mozambique: A windfall for the industry, a curse for the country: New report exposes how the French state and companies fuel violence and devastation in Cabo Delgado�s gas boom�

https://www.foei.org/resources/gas-mozambique-france-report

For previous AfricaFocus Bulletins on climate and the environment, visit http://www.africafocus.org/intro-env.php

++++++++++++++++++++++++++++++++++++++++++++++++++

Announcements: Legacies of Anti-Apartheid Movement

AfricaFocus rarely publishes announcements, but these three notes that came to my attention the week of the July 16 anniversary of the Soweto uprising in 1976, called for making an exception. All three of these are likely to be of interest to many readers of AfricaFocus:

Please share with those in your networks who might be interested.

++++++++++++++++++++++end editor's note+++++++++++++++++

|

Countries must plan orderly exit from oil, gas and coal

https://carbontracker.org/reports/decline-and-fall/

London/New York, June 4 � Falling demand and rising investment risk

is likely to slash the value of oil, gas and coal reserves by

nearly two thirds, sending shock waves through the global economy

by hitting companies, financial markets and countries reliant on

exports, finds a new report from Carbon Tracker.

It warns that the fossil fuel industry is approaching terminal decline because of competition from clean technologies and tougher government polices to achieve climate targets and increase energy security. The COVID-19 crisis is now accelerating this: demand for oil could fall by 9% in 2020 according to the International Energy Agency.[1]

Arnot Power Station, Middelburg, South Africa. Credit: Wikimedia

The size of the fossil fuel economy suggests its decline could pose a significant threat to global financial stability. Companies across the fossil fuel system are worth $18 trillion in listed equity, making up a quarter of the total value of global equity markets, and they account for $8 trillion of corporate bonds, more than half the non-financial corporate bond market. Unlisted debt � �much of it owed to banks � may be four times greater.

The World Bank valued future profits from oil, gas and coal at $39 trillion in 2018 [2], but Carbon Tracker�s report finds that if demand falls by 2% a year in line with the Paris Agreement and discount rates rise in line with increased risk, future profits would collapse by nearly two thirds to just $14 trillion. It also shows that producers expecting a return to business as usual could be banking on much higher profits � well in excess of $100 trillion.

Kingsmill Bond, Carbon Tracker Energy Strategist and report author, said: �We are witnessing the decline and fall of the fossil fuel system. Technological innovation and policy support is driving peak fossil fuel demand in sector after sector and country after country, and the COVID-19 pandemic has accelerated this. We may now have seen peak fossil fuel demand as a whole.

�This is a huge opportunity for countries that import fossil fuels which can save trillions of dollars by switching to a clean energy economy in line with the Paris Agreement. Now is the time to plan an orderly wind-down of fossil fuel assets and manage the impact on the global economy rather than try to sustain the unsustainable.�

Companies like Exxon[3]�are still forecasting continued growth in demand for fossil fuels, and the fossil fuel system as a whole has been investing $5 trillion a year on new supply and demand infrastructure. But Shell�s recent dividend cut, Repsol�s decision to write off �4.8 billion of assets last year, and growing bankruptcies in the US shale oil sector are all symptoms of an industry undergoing structural change.

Decline and Fall: The Size & Vulnerability of the Fossil

Fuel System�sets out how falling demand for fossil fuels

leads to overcapacity, driving prices down, and cutting profits and

company share prices. Many companies will be forced to write off

assets, cancel investment or even go bust. Even companies which

remain profitable will make far less money than before.

The fossil fuel system is enormous, with physical supply and demand

infrastructure worth $32 trillion, and its decline could send

shockwaves through the global economy. It includes: producers of

coal, oil and gas; companies which make and run power stations,

cars, trucks, planes and ships; the steel, cement, petrochemical

and aluminium industries which are heavy users of fossil fuels; and

the companies which supply and build their infrastructure.

The collapse in the scale of future fossil fuel profits could

threaten the stability of petrostates � countries whose economies

rely on oil export income. The world�s biggest earners are Saudi

Arabia, Russia, Iraq and Iran, and countries that are particularly

vulnerable include Venezuela, Ecuador, Libya, Algeria, Nigeria and

Angola.

Investors will be hit because as returns fall, there will be less

capital available for dividends and interest payments. In the UK,

for example, the oil and gas sector generated 24% of dividends from

the FTSE Index in 2019. �Markets might sell down stock in

anticipation of peak demand long before assets are written down.

Companies worth $6 trillion are particularly vulnerable because

they are operating in sectors expanding the fossil fuel system,

from builders of LNG facilities and oil pipelines to makers of

conventional car engines and gas turbines.

The fossil fuel system is highly vulnerable to disruption. Even

before the COVID crisis growth in fossil fuel demand was below 1% a

year and clean technology is now meeting an increasing share of

world energy demand.

Renewables are already the cheapest form of bulk energy production

in 85% of the world, and electric vehicle batteries are comparable

with the cost of conventional car engines. Electricity companies

are rapidly switching to renewables while carmakers are shifting

production to electric vehicles. This is significant because

electricity consumes more than a third of global fossil fuel

production and the greatest demand for oil comes from the

automotive sector.

Governments are supporting clean technology in order to meet the

Paris climate targets and tackle air pollution from fossil fuels,

which kills 4.5 million people a year. Energy security is also a

big incentive for China and India, which are heavily reliant on

fossil fuel imports.

The report notes that fossil fuel importing countries � home to 80%

of global population � also have a financial incentive to back

renewables because they have been transferring over $2 trillion a

year in profits to the petrostates.

It warns investors: �There is far more risk inherent in the fossil

fuel system than is conventionally priced into financial markets.

Investors need to increase discount rates, reduce expected prices,

curtail terminal values and account for the clean-up costs.�

*******************************************************************

Decline and Fall

The size and vulnerability of the fossil fuel system

Carbon Tracker Initiative June 2020

About Carbon Tracker

Carbon Tracker is a team of financial specialists making climate risk real in today�s markets. Our research to date on unburnable carbon and stranded assets has started a new debate on how to align the financial system in the transition to a low carbon economy.

Introduction

Renewable costs are below those of fossil fuels. Five years ago,

fossil fuels were the cheapest baseload. The collapse in renewable

costs means that for 85% of the world, renewable electricity is the

cheapest source of new baseload. By the early 2020s it will be

every major country. Because of the rise of cheap renewables, the

fossil fuel system is ripe for disruption.

This disruption will have profound financial implications for

investors as a quarter of equity markets and half of corporate bond

markets are �carbon entangled�.

Those responsible for our pension schemes should sit up and take

notice; but even greater concern should be felt by financial

regulators, as they grapple with finding the right tools to manage

the risks of a deflating �carbon bubble�.

The world faces two contrasting pathways. Either it can secure the

�trillion dollar green gigafall�, the trillions that can be

generated at low cost from the sun and the wind � particularly

benefiting the poorest inhabitants of the world currently dependent

upon high cost fossil fuel imports. Or it can stay locked into

business as usual, tied into a declining industry that both

threatens the global economy with the worst effects of a warming

planet, and damages investors with losses, low returns and

destabilised equity and credit markets.

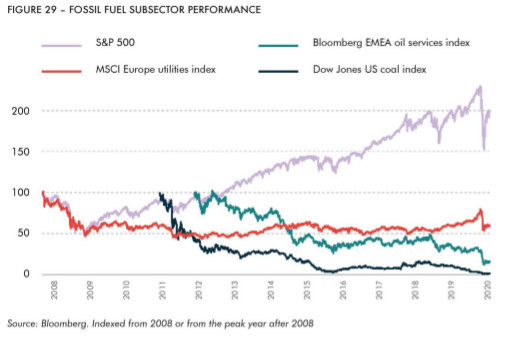

Graph shows performance, compared to S&P, for indexes for oil, utilities, and coal.

In Carbon Tracker�s first report, some ten years ago, entitled

�Unburnable Carbon � are the World�s Financial Markets Carrying a

Carbon Bubble� we highlighted that listed fossil fuel companies

have the potential to develop enough reserves to take the world way

beyond 3 �C.

Our second report, �Unburnable Carbon � Wasted Capital and Stranded

Assets�, noted that if we can�t burn what we have already found,

why continue to invest in the fossil fuel industry�s expansion? Yet

today, we know that some $1 trillion is spent annually on expanding

supply and this report goes more into these numbers. Before we wind

down the fossil fuel system, we need to stop expanding it.

Some argue that �fossil fuels will go away of their own accord� as

the result of the rapid progress made by cleaner technologies and

the collapse in demand for fossil fuels driven by the terrible

COVID-19 epidemic. Unfortunately, as this report makes clear,

financial markets are still heavily tied in to the fossil fuel

system.

So what are our recommendations? In the same way that our first

report was aimed at financial regulators, this one is also to be

carefully read by those responsible for financial oversight. We

advise now a rapid acceleration of disclosure and reporting systems

around climate risk that allow investors to properly calculate

risk. Thus analysis should be based on actual Paris alignment

(which requires contraction of supply and demand), not models based

on the neverland of �we�ll have it sorted out in 2040�. This

requires companies to implement the appropriate accounting

measures, particularly relating to asset write-downs and

depreciation.

We believe companies will face major asset write downs as it

becomes clear that high-cost fossil fuel supply and demand

infrastructure has limited value. An example of this in 2019 was

Repsol, which took �4.8bn of write-downs on its fossil fuel assets.

Because of leverage, this was only 8% of assets, but 16% of equity.

To avoid the impacts of a disorderly wind down, we expect

regulators to require companies to undertake tougher impairment

tests. For example, by providing clear guidance frameworks for

asset impairment, including goodwill, in line with the goals of the

Paris climate agreement. This would include fossil fuel encumbered

companies having to publish stress tests, consistent with the Paris

goals, on the financial impact of changes in the useful life of

assets; changes in the fair valuation of assets; the effects on

impairment calculations because of increased costs or reduced

demand and changes in provisions for onerous contracts because of

increased costs or reduced demand. Running supply of fossil fuels

down to meet what the science demands means rapid contraction of

oil and gas supply and the closure of around one coal fired power

station a day.

With proper risk disclosure, credit and equity analysts will be

better able to test the resilience of individual fossil fuel

companies to the financial storm. A storm which, as this report

sets out, is fast descending upon us.

Mark Campanale, Founder & Executive Chair

Jon Grayson, CEO

************************************************************

Standard Bank board: Fossil fuel ties brought to light

Seven of Standard Bank�s 18 board members are conflicted on climate change-related matters by virtue of their ties to the fossil fuel industry.

ESI Africa, June 8, 2020

https://www.esi-africa.com/industry-sectors/business-and-markets/standard-bank-board-fossil-fuel-ties-brought-to-light/

Fourteen climate justice NGOs from around the world, led by

shareholder activist organisation Just Share, have called on

Standard Bank�s shareholders to vote against the election/re-

election of climate-conflicted directors at the upcoming AGM.

Standard Bank�acknowledges�that �climate risk is recognised as one of the material risks facing the group�. The bank is a founding signatory of the�UN Principles for Responsible Banking�(UNPRB), which �set the global benchmark for what it means to be a responsible bank�.

Principle 1 of the UNPRB (�Alignment�), commits signatory banks to

�align [their] business strategy to be consistent with and

contribute to individuals� needs and society�s goals, as expressed

in the Sustainable Development Goals, the Paris Climate Agreement

and relevant national and regional frameworks�.

One of the Paris Agreement�s three main objectives is �making

finance flows consistent with a pathway towards low greenhouse gas

emissions and climate-resilient development�. The financing of

fossil fuels, in particular new fossil fuel exploration, extraction

and production, is not compatible with the Paris Agreement.

A large proportion of Standard Bank�s board members have ties to

South African fossil fuel companies, including Sasol (the country�s

biggest carbon emitter after Eskom), Exxaro and BP Southern Africa.

Five of the seven directors with fossil fuel ties are up for

election or re-election at the company�s AGM on 26 June. �

If all of the directors standing for election or re-election are

elected at the 26 June AGM, directors with fossil fuel ties will

represent 42% of Standard Bank�s independent directors (5/12); 47%

of its non-executive directors (7/15); and 41% (7/17) of the board

as a whole.�

Board members with a conflict of interest are required by the

Companies Act, 2008 to declare those interests and to recuse

themselves from board meetings during consideration of any matter

in relation to which they are conflicted. �

In these circumstances, responsible investors holding Standard Bank

shares are faced with no good options: either these board members

will recuse themselves, creating a corporate governance void when

the board considers some of its most important strategic issues as,

by the bank�s own admission, climate-related matters are; or they

will not, compromising the ability of the board to provide climate-

competent leadership.

[Article continues at https://www.esi-africa.com/industry-sectors/business-and-markets/standard-bank-board-fossil-fuel-ties-brought-to-light/. Also see additional coverage at https://www.dailymaverick.co.za/article/2020-06-09-climate-change-activists-target-standard-bank-board-over-fossil-fuel-links/#gsc.tab=0

********************************************************

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at [email protected]. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned.

see http://www.africafocus.org

To subscribe to receive future bulletins by email,

click here.

|