|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: State of Tax Justice 2020

AfricaFocus Bulletin

December 14, 2020 (2020-12-14)

(Reposted from sources cited below)

Editor's Note

�Of the $427 billion in tax lost each year globally to tax havens,

the State of Tax Justice 2020 reports that $245 billion is directly

lost to corporate tax abuse by multinational corporations and $182

billion to private tax evasion. Multinational corporations paid

billions less in tax than they should have by shifting $1.38

trillion worth of profit out of the countries where they were

generated and into tax havens, where corporate tax rates are

extremely low or non-existent. Private tax evaders paid less tax

than they should have by storing a total of over $10 trillion in

financial assets offshore.� - Tax Justice Network, November 2020.

This AfricaFocus Bulletin contains the full press release from Tax

Justice Network, as well as links to related reports from ActionAid

and the International Consortium of Investigative Journalists. All

three reports are available in full at the links given.

For previous AfricaFocus Bulletins on tax justice and illicit

international flows, visit

http://www.africafocus.org/intro-iff.php

This will be the last AfricaFocus Bulletin for 2020. Publication

will be resumed in mid-to-late January 2021. Best wishes to all our

readers for your safety and your work for social justice in the

coming year.

++++++++++++++++++++++++++++++++++++++++++++++++++

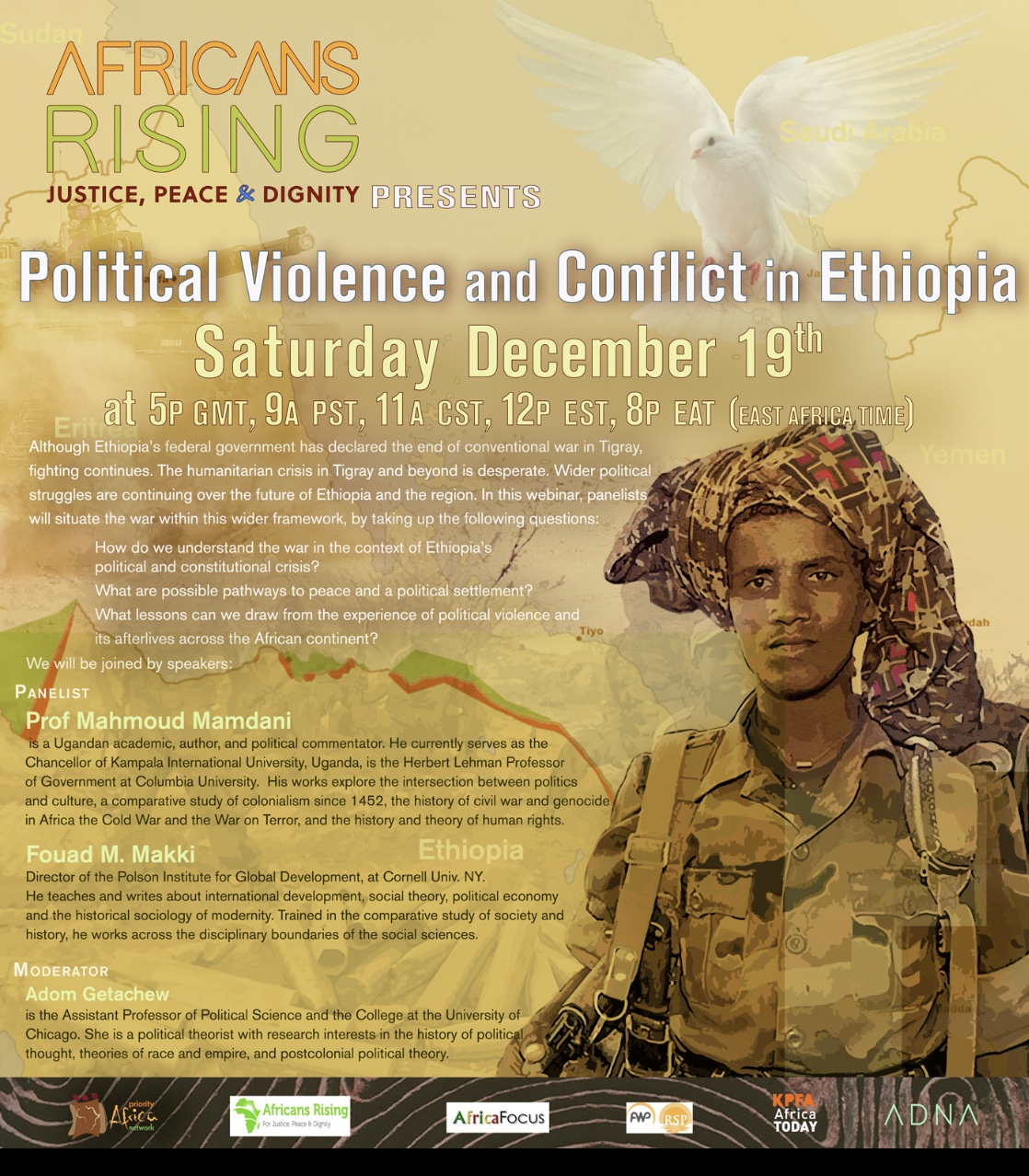

Political Violence and Conflict in Ethiopia

Webinar with Africans Rising

Saturday, December 19th 5pm GMT

(9 am Pacific/11 Central/12pm Eastern)

RSVP for Zoom meeting: https://bit.ly/37a3BWg. Event will also be live streamed on Facebook at https://facebook.com/AfricansRising/videos and also be available on YouTube.

Although Ethiopia�s federal government has declared the end of

conventional war in Tigray, fighting continues. The humanitarian

crisis in Tigray and beyond is desperate. Wider political struggles

are continuing over the future of Ethiopia and the region. In this

webinar, panelists will situate the war within this wider

framework, by taking up the following questions:

- How do we understand the war in the context of Ethiopia�s political and constitutional crisis?

- What are possible pathways to peace and a political settlement?

- What lessons can we draw from the experience of political violence and its afterlives across the African continent?

Adom Getachew, University of Chicago, will chair the webinar. The first panelist will be Mahmood Mamdani, of Kampala International University and Columbia University, followed by discussants Fouad M. Makki, Cornell University, and Adom Getachew.

The event is co-sponsored by Priority Africa Network, Africans Rising, AfricaFocus Bulletin, Advocacy Network for Africa (ADNA), AfricaWorld Press / Red Sea Press, and KPFA/Africa Today.

|

|

|

++++++++++++++++++++++end editor's note+++++++++++++++++

Reports from ActionAid and International Consortium of Investigative Journalists (ICIJ)

Action Aid, October 26, 2020

https://actionaid.org/news/2020/28bn-tax-gap-exposed-actionaid-research-reveals-tip-iceberg-big-techs-big-tax-bill-global

- New research from ActionAid International reveals that 20 developing countries could be missing out on as much as $2.8bn in tax revenue from Facebook, Alphabet Inc. (parent company of Google) and Microsoft due to unfair global tax rules.

- Potential taxes raised from these three �Big Tech� companies alone could address the World Health Organisation�s (WHO) estimated shortages of more than 1.7 million nurses in these countries within just three years.

- $2.8bn could pay for 729,010 nurses, 770,649 midwives or 879,899 primary school teachers each year in 20 countries across Africa, Asia and South America.

[Full press release and report available at link above.]

International Association of Investigative Journalists

Will Fitzgibbon, �After Luanda Leaks, a billionaire�s empire falls, but her enablers carry on

ICIJ, December 7, 2020

https://www.icij.org/investigations/luanda-leaks/after-luanda-leaks-a-billionaires-empire-falls-but-her-enablers-carry-on/

In January, the International Consortium of Investigative

Journalists and partners in 20 countries published the Luanda Leaks

investigation, documenting two decades of inside deals and

government giveaways, aided by Western lawyers and advisers, that

made Isabel dos Santos, the daughter of the southern African

country�s long time strongman ruler, enormously rich.

�

Rarely has a billionaire fallen so far, so fast. But in Angola and

beyond, the systemic ills the Luanda Leaks investigation brought

into focus � corruption, the flight of wealth to offshore centers

and a sprawling dark money industry that enables and accelerates

the looting of entire nations � remain largely untreated.

�

Luanda Leaks was key for increased anti-corruption activism in

Angola and brought new attention to accountants and others who are

complicit in the systemic diversion of public funds for private

gain,� said Karina Carvalho, the Angolan-born executive director of

Transparency International in Portugal.

�But,� Carvalho added, �I also see the continuity of power

structures that prevent the return of stolen assets to the Angolan

people and protect gatekeepers who profit from money laundering and

tax evasion. These enablers bear a share of responsibility for the

poor living conditions, even starvation and death, faced by

millions of people around the world.�

[Full article and report available at link above.]

*****************************************************************

$427bn lost to tax havens every year: landmark study reveals countries� losses and worst offenders

Mark Bou Mansour

Tax Justice Network

Press Release, 20 November 2020

https://www.taxjustice.net/2020/11/20/427bn-lost-to-tax-havens-every-year-landmark-study-reveals-countries-losses-and-worst-offenders/

The equivalent of one nurse�s annual salary is lost to a tax haven

every second

Countries are losing a total of over $427 billion in tax each year

to international corporate tax abuse and private tax evasion,

costing countries altogether the equivalent of nearly 34 million

nurses� annual salaries every year � or one nurse�s annual salary

every second. As pandemic-fatigued countries around the world

struggle to cope with second and third waves of coronavirus, a

ground-breaking study published today reveals for the first time

how much public funding each country loses to global tax abuse and

identifies the countries most responsible for others� losses. In a

series of joint national and regional launch events around the

world, economists, unions and campaigners are urging governments to

immediately enact long-delayed tax reform measures in order to

clamp down on global tax abuse and reverse the inequalities and

hardships exacerbated by tax losses.

The inaugural edition of the State of Tax Justice � an annual

report by the Tax Justice Network on the state of global tax abuse

and governments� efforts to tackle it, published today together

with global union federation Public Services International and the

Global Alliance for Tax Justice � is the first study to measure

thoroughly how much every country loses to both corporate tax abuse

and private tax evasion, marking a giant leap forward in tax

transparency.

While previous studies on the scale of global corporate tax abuse

have had to contest with the fog of financial secrecy surrounding

multinational corporations� tax affairs, the State of Tax Justice

analyses data that was self-reported by multinational corporations

to tax authorities and recently published by the OECD, allowing the

report authors to directly measure tax losses arising from

observable corporate tax abuse. The data, referred to as country by

country reporting data, is a transparency measure first proposed by

the Tax Justice Network in 2003. After nearly two decades of

campaigning, the data was made available to the public by the OECD

in July 2020 � although only after multinational corporations� data

was aggregated and anonymised.

Of the $427 billion in tax lost each year globally to tax havens,

the State of Tax Justice 2020 reports that $245 billion is directly

lost to corporate tax abuse by multinational corporations and $182

billion to private tax evasion. Multinational corporations paid

billions less in tax than they should have by shifting $1.38

trillion worth of profit out of the countries where they were

generated and into tax havens, where corporate tax rates are

extremely low or non-existent. Private tax evaders paid less tax

than they should have by storing a total of over $10 trillion in

financial assets offshore.

Poorer countries are hit harder by global tax abuse

While higher income countries lose more tax to global tax abuse,

the State of Tax Justice 2020 shows that tax losses bear much

greater consequences in lower income countries. Higher income

countries altogether lose over $382 billion every year whereas

lower income countries lose $45 billion. However, lower income

countries� tax losses are equivalent to nearly 52 per cent of their

combined public health budgets, whereas higher income countries�

tax losses are equivalent to 8 per cent of their combined public

health budgets. Similarly, lower income countries lose the

equivalent of 5.8 per cent of the total tax revenue they typically

collect a year to global tax abuse whereas higher income countries

on average lose 2.5 per cent.

The same pattern of global inequality is also strongly visible when

comparing regions in the global north and south. North America and

Europe lose over $95 billion in tax and over $184 billion

respectively, while Latin America and Africa lose over $43 billion

and over $27 billion respectively. However, North America and

Europe�s tax losses are equivalent to 5.7 per cent and 12.6 per

cent of the regions� public health budgets respectively, while

Latin America and Africa�s tax losses are equivalent to 20.4 per

cent and 52.5 per cent of the regions� public health budgets

respectively.

Rich countries are responsible for almost all global tax losses

Assessing which countries are most responsible for global tax

abuse, the State of Tax Justice 2020 provides the strongest

evidence to date that the greatest enablers of global tax abuse are

the rich countries at the heart of the global economy and their

dependencies � not the countries that appear on the EU�s highly

politicised tax haven blacklist or the small palm-fringed islands

of popular belief. Higher income countries are responsible for 98

per cent of countries� tax losses, costing countries around the

world over $419 billion in lost tax every year while lower income

countries are responsible for just 2 per cent, costing countries

over $8 billion in lost tax every year.

The five jurisdictions most responsible for countries� tax losses

are British Territory Cayman (responsible for 16.5 per cent of

global tax losses, equal to over $70 billion), the UK (10 per cent;

over $42 billion), the Netherlands (8.5 per cent; over $36

billion), Luxembourg (6.5 per cent; over $27 billion) and the US

(5.53 per cent; over $23 billion).

G20 countries meeting tomorrow responsible for over a quarter or

global tax losses

G20 member countries meeting this weekend for the Leaders� Summit

2020 are collectively responsible for 26.7 per cent of global tax

losses, costing countries over $114 billion in lost tax every year.

The G20 countries themselves also lose over $290 billion each year.

In 2013, the G20 mandated the OECD to require collection of the

country by country reporting data analysed by the State of Tax

Justice 2020 � a measure the OECD had long resisted until then. In

2020, the OECD�s consultation on country by country reporting

highlighted two major demands from investors, civil society and

leading experts: that the technical standard be replaced with the

far more robust Global Reporting Initiative standard, and �

crucially � that the data be made public.

The Tax Justice Network is calling on the G20 heads of state summit

this weekend to require the publication of individual

multinationals� country by country reporting, so that corporate tax

abusers and the jurisdictions that facilitate them can be

identified and held to account.

Alex Cobham, chief executive of the Tax Justice Network, said:

�A global tax system that loses over $427 billion a year is not a

broken system, it�s a system programmed to fail. Under pressure

from corporate giants and tax haven powers like the Netherlands and

the UK�s network, our governments have programmed the global tax

system to prioritise the desires of the wealthiest corporations and

individuals over the needs of everybody else. The pandemic has

exposed the grave cost of turning tax policy into a tool for

indulging tax abusers instead of for protecting people�s wellbeing.

�Now more than ever we must reprogramme our global tax system to

prioritise people�s health and livelihoods over the desires of

those bent on not paying tax. We�re calling on governments to

introduce an excess profit tax on large multinational corporations

that have been short-changing countries for years, targeting those

whose profits have soared during the pandemic while local

businesses have been forced into lockdown. For the digital tech

giants who claim to have our best interests at heart while having

abused their way out of billions in tax, this can be their

redemption tax. A wealth tax alongside this would ensure that those

with the broadest shoulders contribute as they should at this

critical time.�

Rosa Pavanelli, general secretary at Public Services International, said:

�The reason frontline health workers face missing PPE and brutal

understaffing is because our governments spent decades pursuing

austerity and privatisation while enabling corporate tax abuse. For

many workers, seeing these same politicians now �clapping� for them

is an insult. Growing public anger must be channelled into real

action: making corporations and the mega rich finally pay their

fair share to build back better public services.

�When tax departments are downsized and wages cut, corporations and

billionaires find it even easier to swindle money away from our

public services and into their offshore bank accounts. This is of

course no accident; many politicians have wilfully sent the guards

home. The only way to fund the long-term recovery is by making sure

our tax authorities have the power and support they need to stop

corporations and the mega rich from not paying their fair share.

The wealth exists to keep our societies functioning, our vulnerable

alive and our businesses afloat: we just need to stop it flowing

offshore.

�Let�s be clear. The reason corporations and the mega rich abuse

billions in taxes isn�t because they�re innovative. They do it

because they know politicians will let them get away with it. Now

that we�ve seen the brutal results, our leaders must stop the

billions flowing out of public services and into offshore accounts,

or risk fuelling cynicism and distrust in government.�

Dr Dereje Alemayehu, executive coordinator at the Global Alliance for Tax Justice, said:

�The State of Tax Justice 2020 captures global inequality in

soberingly stark numbers. Lower income countries lose more than

half what they spend on public health every year to tax havens �

that�s enough to cover the annual salaries of nearly 18 million

nurses every year. The OECD�s failure to deliver meaningful

reforms8 to global tax rules in recent years, despite the repeated

declaration of good will, makes it clear that the task was

impossible for a club of rich countries. With today�s data showing

that OECD countries are collectively responsible for nearly half of

all global tax losses, the task was also clearly an inappropriate

one for a club heavily mixed up in global tax havenry.

�We must establish a UN tax convention to usher in global tax

reforms. Only by moving the process for setting global tax

standards to the UN can we make sure that international tax

governance is transparent and democratic and our global tax system

genuinely fair and equitable, respecting the taxing rights of

developing countries.�

Country cases of tax losses

Tax abuse in Vietnam causes as much economic loss as Typhoon Molave

Typhoon Molave, described by Vietnamese Deputy Prime Minister Trinh

Dinh Dung as �one of the two most powerful storms Vietnam has had

in the past 20 years,� destroyed more than 700 houses and left 80

people dead and missing in October 2020. The Vietnamese government

estimates Typhoon Molave to have caused $430 million in economic

damage. Vietnam loses nearly as much tax, over $420 million (97 per

cent of $430 billion), every year to global tax abuse.

South Africa�s tax losses could lift over 3 million people out of

poverty

Nearly half of South Africa�s adult population lives in poverty,

with more women (52 per cent) in poverty, than men (46 per cent).

The latest upper-bound poverty line published by the South African

government in 2019 is ZAR 1,227 per month (almost $85 per month).

If the $3.39 billion in tax that South Africa loses every year to

tax abuse was instead given as direct cash transfers of $85 per

month to people living in poverty, over 3 million people could be

lifted out of poverty.

Greece�s tax losses equal to over a quarter of scheduled debt

repayments

Greece�s annual loss of nearly $1.36 billion in tax (�1.15 billion)

to tax abuse is equivalent to over a quarter (27 per cent) of

Greece�s scheduled debt repayments for 2020, which total �4.19

billion.12 Among the multiple debtors Greece owes, the country is

specifically scheduled to repay �443.7m to Eurozone countries in

2020. Greece�s annual tax losses are over double this amount.

Responsibility for global tax losses

The UK spider�s web is responsible for over a third of global tax

losses

The jurisdiction that causes countries the most global tax losses

is British Overseas Territory Cayman, which is responsible for

other countries losing over $70 billion in tax every year. However,

Cayman is just one jurisdiction that falls under UK�s network of

Overseas Territories and Crown Dependencies, where the UK has full

powers to impose or veto lawmaking and where power to appoint key

government officials rests with the British Crown. Infamously

referred to as the UK spider�s web, extensive research has

documented the ways in which this network of jurisdictions operates

as a web of tax havens facilitating corporate and private tax

abuse, at the centre of which sits the City of London.

The State of Tax Justice 2020 finds that the UK spider�s web is

responsible for 37.4 per cent of all tax losses suffered by

countries around the world, costing countries over $160 billion in

lost tax every year.

The �axis of tax avoidance� is responsible for over half of the

world�s tax losses

The Corporate Tax Haven Index 2019 had previously estimated that

the UK, together with its network of Overseas Territories and Crown

Dependencies, Luxembourg, Switzerland and the Netherlands are

together responsible for half of the world�s risk of corporate tax

abuse, coining the label �axis of tax avoidance� for the group. The

Tax Justice Network revealed in April 2020 that the axis of tax

avoidance costs the EU over $27 billion in lost tax every year

solely from US multinational corporations operating in the EU.

The State of Tax Justice Network confirms today that the axis of

tax avoidance is collectively responsible for over 47.6 per cent of

global tax loss incurred from corporate tax abuse. When including

tax losses to private tax evasion, the axis of tax avoidance is

responsible for 55 per cent of all tax losses suffered by countries

around the world, costing countries nearly $237 billion in lost tax

every year.

EU blacklisted jurisdictions cause less than 2% of global tax

losses, EU member states cause 36%

Analysis of the jurisdictions on the EU tax haven blacklist found

the cohort to be collectively responsible for just 1.72 per cent of

global tax losses, costing countries over $7 billion in lost tax a

year.16 In comparison, EU member states are responsible for 36 per

cent of global tax losses, costing countries over $154 billion in

lost tax every year.

The Tax Justice Network has long criticised the EU�s blacklist for

ignoring major tax havens while focusing on jurisdictions that are

secretive but play an insignificant role in the global economy. The

State of Tax Justice 2020 reveals that two jurisdictions

blacklisted by the EU, Palau and Trinidad and Tobago, while non-

cooperative with international tax regulations, did not create any

observable tax losses for other countries.

On the other hand, British Territory Cayman which was briefly

blacklisted for the first time in February 202018 but removed from

the list in October 2020 after it was deemed compliant with

international tax rules, is responsible for the biggest share of

countries� tax losses (16.5 per cent of global tax losses, equal to

over $70 billion a year). The Tax Justice Network argues that

Cayman being deemed to be compliant with international tax rules

despite being the world�s greatest enabler of global tax abuse is

evidence that current international tax rules are not fit for

purpose.

Three actions governments must take

The Tax Justice Network, Public Services International and the

Global Alliance for Tax Justice, along with supporting NGOs,

campaigners and experts around the world, are together calling on

governments to take three actions to tackle global tax abuse:

Introduce an excess profit tax on multinational corporations making

excess profits during the pandemic, such as global digital

companies, in order to cut through profit shifting abuses.

Multinational corporations� excess profit would be identified at

the global level, not the national level, to prevent corporations

from underreporting their profits by shifting them into tax havens,

and taxed using a unitary tax method.

Introduction of a wealth tax to fund the Covid-19 response and

address the long term inequalities the pandemic has exacerbated,

with punitive rates for opaquely owned offshore assets and a

commitment between governments to eliminate this opacity. The

pandemic has already seen an explosion in the asset values of the

wealthy, even as unemployment has soared to record levels in many

countries.

Establish a UN tax convention to ensure a global and genuinely

representative forum to set consistent, multilateral standards for

corporate taxation, for the necessary tax cooperation between

governments, and to deliver comprehensive, multilateral tax

transparency.

-ENDs-

Contact the press team: [email protected] or +44 (0)7562 403078

About the Tax Justice Network

The Tax Justice Network believes a fair world, where everyone has

the opportunities to lead a meaningful and fulfilling life, can

only be built on a fair code of tax, where we each pitch in our

fair share for the society we all want. Our tax systems, gripped by

powerful corporations, have been programmed to prioritise the

desires of the wealthiest corporations and individuals over the

needs of everybody else. The Tax Justice Network is fighting to

repair this injustice. Every day, we equip people and governments

everywhere with the information and tools they need to reprogramme

their tax systems to work for everyone.

About Public Services International

Public Services International is a Global Union Federation of more

than 700 trade unions representing 30 million workers in 154

countries. We bring their voices to the UN, ILO, WHO and other

regional and global organisations. We defend trade union and

workers� rights and fight for universal access to quality public

services.

About the Global Alliance for Tax Justice

The Global Alliance for Tax Justice is a growing movement of civil

society organisations and activists, united in campaigning for

greater transparency, democratic oversight and redistribution of

wealth in national and global tax systems. We comprise the five

regional tax justice networks of Africa, Latin America, Asia, North

America and Europe, which collectively represent hundreds of

organisations.

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter. For an archive of previous Bulletins,

see http://www.africafocus.org,

Current links to books on AfricaFocus go to the non-profit bookshop.org, which supports independent bookshores and also provides commissions to affiliates such as AfricaFocus.

AfricaFocus Bulletin can be reached at [email protected]. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned. To subscribe to receive future bulletins by email,

click here.

|